Hipgnosis Songs Fund Agrees $1.4B Sale to Concord Chorus

The deal values each Hipgnosis share at £0.93, a premium of roughly one third the royalty fund's shareprice at the close of trading on Wednesday.

The troubled music royalty company Hipgnosis Songs Fund (HSF) has agreed to a $1.402 billion takeover bid from Nashville-based rival Concord, according to a filing made Thursday (April 18) to the London Stock Exchange.

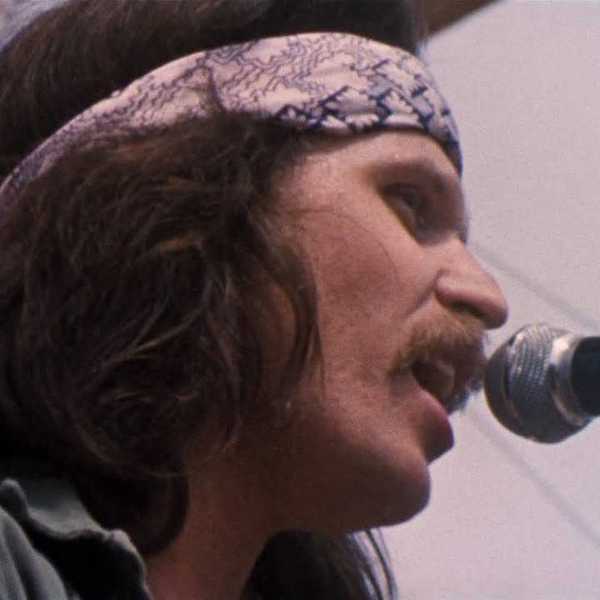

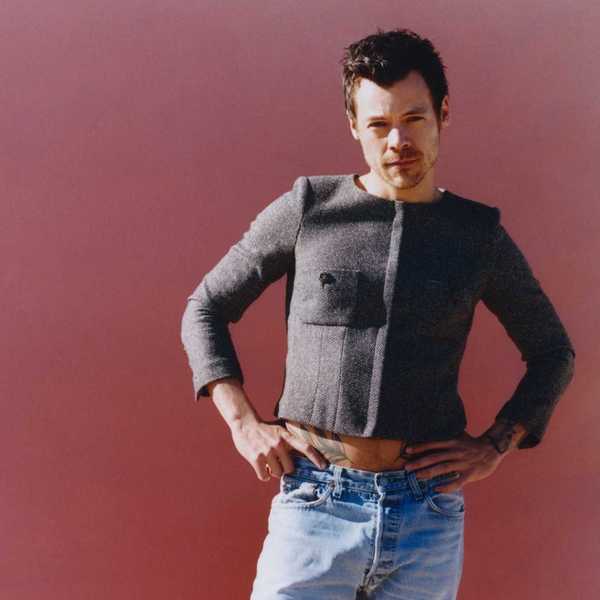

The deal values each Hipgnosis share at £0.93, a premium of roughly one third the fund’s closing shareprice on Wednesday, and shareholders controlling nearly 30% of the company are supporting it, according to the filing. Hipgnosis Songs Fund’s assets include stakes in songs by Neil Young, Justin Bieber, Journey, Lindsey Buckingham, Blondie and Justin Timberlake, among others.

“The board is pleased to announce and unanimously recommend this US$1.4 billion offer for Hipgnosis from Concord,” Robert Naylor, chairman of Hipgnosis, said in a statement. The acquisition “represents an attractive opportunity for our shareholders to immediately realize their holding at a premium, mitigating the risks we see ahead to achieving a material improvement in the share price.”

The annoncement comes roughly six months after shareholders rejected another proposed sale and voted no to continuation–the equivalent of a vote of no confidence in the 5-year-old fund’s previous board and its investment advisor, Hipgnosis Song Management.

In the intervening months, the board of directors has been almost entirely reconstituted by Naylor, who became chairman last November, and Hipgnosis’ founder, the former manager of artists like Elton John, Beyoncé and Guns N’ Roses, Merck Mercuriadis stepped down from his role as chief executive officer of Hipgnosis Song Management in February.

Matters took another turn last month when HSF, which has amassed a catalog that includes stakes in songs by Neil Young, Justin Bieber, Journey, Lindsey Buckingham, Blondie, Justin Timberlake and many other artists and writers, cut the value of its portfolio by more than a quarter and told investors that it does not intend to recommence paying dividends “for the foreseeable future” as it focuses on paying down debts.

Compiled by the board’s lead independent adviser, Shot Tower Capital, the report found that Hipgnosis Song Management, run by Hipgnosis founder and music manager Merck Mercuriadis, materially overstated the fund’s revenue and earnings before interest, taxes, depreciation and amortization (EBITDA) and supported catalog acquisitions with financial analysis that failed to meet “music industry standards.”

HSF itself overstated the scope of its music assets, the report noted, in disclosures to investors and regulators. And in a pitch last September to investors to sell some 29 catalogs to a sister Hipgnosis company, the fund included a better-than-could-be-expected post-deal valuation, the report found.

Following completion of the acquisition and a short transition period, reads a statement to the London Stock Exchange, it is expected that Concord will take over the management of Hipgnosis’ assets, adding to a business that, since 2015, has completed more than 100 transactions across recorded music, music publishing and theatricals, in a US$2.8 billion spending spree.

The Hipgnosis board, Naylor continues, is confident that Concord is the “right owner” to take on the Hipgnosis catalogue and manage it in the interests of composers and performers.

The offer has been unanimously recommended by its board and has the support of 29.38 per cent of their shareholders, comments Bob Valentine, CEO of Concord, controlled by investor Alchemy Copyrights. “We believe we are offering a fair price for Hipgnosis’ catalogues and music assets, giving its shareholders the opportunity to realize their investment at a significant premium to the prevailing share price in cash.”

Concord’s leadership identifies Hipgnosis’ assets as further means to grow its business and scale and leverage its operations.

“Concord and its management have followed the progression of Hipgnosis since IPO and believe that Hipgnosis’ assets complement Concord’s long-standing objective to acquire high quality and long-term music assets,” according to Concord’s statement. “Concord believes that the quality of Hipgnosis’ assets are consistent with Concord’s existing holdings, and creators connected to the rights acquired will benefit from the services of Concord’s existing creative and administrative support teams globally.”