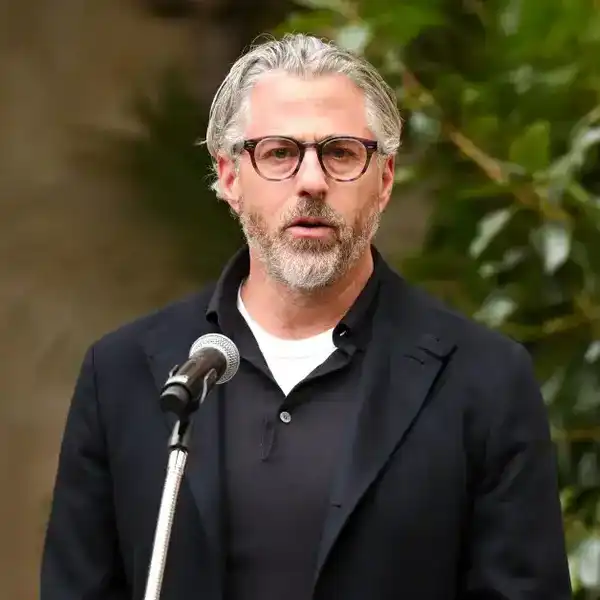

Mark Mulligan: Spotify's New Rules Of Engagement

The preeminent streaming service is walking on shaky ground in announcing it is willing to do direct deals with some artists and managers as it hopes to maintain necessary ties with record labels.

By External Source

When Spotify reported its Q1 earnings, the music industry consensus was a job well done. It delivered nearly on-target revenues (though they were down slightly on Q4), solid subscriber growth, improved margins and reduced churn. But it wasn’t enough for Wall Street. Spotify’s stock price fell to $150.07 down from a high of $170 in the days building up to the earnings. So what went wrong? Investors were expecting Spotify to pull a rabbit out of the hat. They’d been promised an industry-changing investment and had instead got an industry sustaining investment. Such fickle investor confidence so early on in the history of a public company can be fatal. So, Spotify quickly searched for that rabbit; it announced that it will do direct deals with some artists and managers. Guess what happened? Spotify’s stock price rose to $172.37. The rabbit was bounding across the stage.

Investors want the new world now

These are the new rules of streaming music. As the bellwether of streaming, Spotify has been dictating the narrative for years, but always with the focus of being a partner for rights holders. Now that it is public, Spotify has found that tough-talking trumps sweet talking. Even if Spotify does not intend to go fast on its next gen-label strategy, it now knows it has to talk fast. Speaking from the experience of months of deep conversations with large institutional investors, Wall Street has pumped money into Spotify stock not because of how it will help labels’ businesses, but because they expect it to replace labels, or, at the very least, compete with them at scale. Spotify’s stock was not cheap, so to deliver to investors the returns they crave, it has to show that its influence is as disruptive / innovative (delete depending on your perspective) for the music business as Netflix has been for the TV business. They are investing in the potential upside on a future industry changer, not a present-day industry defender.

– Excerpted from Spotify's New Rules Of Engagement, published on Mark Mulligan's Music Industry Blog