Nordicity Live Facts & Figures

The Canadian Live Music Association-commissioned report, R

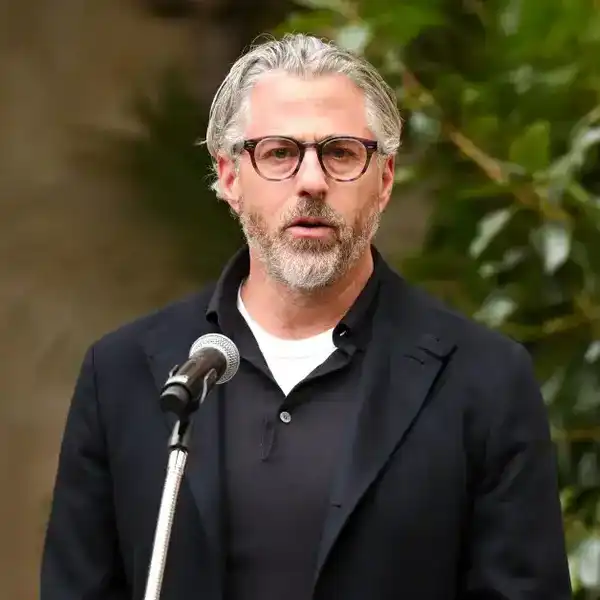

By Nick Krewen

The Canadian Live Music Association-commissioned report, Re:Venues, A Case and Path Forward for Toronto's Live Music Scene, offers crucial information about the city's musical nightlife and the stultifying curse the pandemic has placed upon it.

Researched over a period of two years, and co-financed by the City of Toronto, Ontario Creates, Music Canada and others, the Nordicity study outlines the following stats in its report:

588 venues comprise Toronto’s core live music ecosystem, with 236 touting music as integral to their business.

Concert halls and theatres constitute 25% of the 536 active venues in the city, with bars and pubs comprising 23% of the total

advertisementIn 2019, an estimated 107,000 individual acts were hosted by Toronto live music venues, with most offering live music an average of four days a week. 64% of these acts perform original music.

Rising rents and redevelopment forced “an alarming number” of venues to close their doors pre-Covid, with other factors ranging from a lack of affordable housing and studios forcing an exodus of musicians from Toronto.

The 2013 creation of the Toronto Music Advisory Committee has been instrumental in developing Toronto’s Music Strategy (2016) and helping introduce 2020’s Venue Property Tax Relief.

There is no City of Toronto business licence directly tailored to venues. Therefore, many are technically licenced as restaurants although their activities reflect a nightclub or entertainment establishment.

In the survey, which was completed prior to the onset of Covid-19, 42% of the participating venues owned their operating space.

93% of the venues contain permanent sound equipment; while 86% have a permanent stage. 67% sport in-house technicians.

73% of venues have undergone efforts to make their space more inclusive and more accessible to people with disabilities.

The cottage industry created by live music ranges from positions at the venues themselves, concert promoters, recording labels, studios, festivals, and related businesses, as well as the economic growth of other businesses/sectors in the city. Respondent venues reported an average staff of 3.6 full-time and 4.9 part-time employees.

advertisementWhile the largest concentration of music venues is in Toronto’s downtown core, pockets of venue activity exist across the City

The direct, indirect and induced financial impact of live music in Toronto generates $852.2M in GPP, $514M in labour income, $62.1M in provincial and federal fiscal impact and employs 10,510.

20 cents of every dollar spent by a music venue goes towards rent and mortgage.

Changing neighbourhood demographics are eroding live venue clientele, and those new to neighbourhoods are seeking to curtail venue operations.

Increased venue costs (i.e. insurance premiums) are being shifted to the artists through rental and guarantee deposits.