Luminate 2023 Year-End Report Reveals Canadian Album Sales Declining

The data company's year-end report for 2023 highlights trends in genre growth, gender gaps, super fans and more. Plus: the year's biggest albums and songs in Canada.

In 2023, Canadian total album consumption was up, while album sales — including physical and digital — declined slightly, according to the Luminate Year-End Music Report released today.

Luminate is a data company that serves as a major resource for the entertainment industry: the company tabulates Billboard's charts, as well as providing data for the film and TV industries.

While Luminate usually releases a separate Canadian report, this year the country's data is included with the full global report.

Billboard has a full breakdown of the report, including the year’s top 10 albums chart, along with other year-end rankings and overall industry volume numbers here.

In Canada: Catalogues Are Strong, But Album Sales Are Down

Total album consumption in Canada in 2023 was 107.2 million units, up from 93.2 million in 2022, representing a 15% growth. That growth was larger than in the American market, where total album consumption grew by 12.6%. On-demand song streaming also grew by 18%, rising from 122.7 billion streams to 145.1 billion. Album sales, though, saw a slight drop, from 5.2 million to 5.1 million, or 1.9%. In the U.S., album sales grew by 5.2%, from 100.1 million sales to 105.3 million.

Luminate also compared growth in catalogue consumption versus current release consumption, and found that in Canada, catalogues represented 73.1% of music consumption, while current releases represented only 26.9%. Catalogue consumption also grew more than current release consumption, at 17.4% versus 9.1%. That finding is consistent with the Billboard Canadian year-end album chart, which shows that older Canadian albums were among the most-listened-to of the year. (For comparison, the U.S. split between catalogue and current is fairly similar, though catalogue is growing at only 13.2%, and current releases are growing at 10.9%).

Canada also came in at number nine on Luminate's list of the top ten countries by streaming volume, with 145.3 billion streams. The U.S. is number one, followed by India, Brazil, Mexico, Indonesia, Germany, Japan and the United Kingdom. Canada doesn't appear on the top ten countries by streaming growth list, however, where India takes the number one spot, followed by the U.S., Indonesia, Brazil, Mexico, Japan, South Korea, Turkey, the Philippines and the United Kingdom. Canada is also one of five countries outside of the U.S. where hip-hop and R&B perform the best on streaming.

Canada's Top Albums & Songs

The report includes top 10 lists for top albums and songs in Canada. Here they are, below:

TOP 10 ALBUMS OF 2023 IN CANADA, BY TOTAL EQUIVALENT ALBUM UNITS

1. Morgan Wallen, One Thing at a Time

2. Taylor Swift, Midnights

3. SZA, SOS

4. Morgan Wallen, Dangerous: The Double Album

5. Metro Boomin, Heroes & Villains

6. Taylor Swift, 1989 (Taylor’s Version)

7. Taylor Swift, Lover

8. The Weeknd, The Highlights

9. Luke Combs, Gettin' Old

10. Elton John, Diamonds

TOP 10 SONGS OF 2023 IN CANADA, BY AUDIO + VIDEO ON-DEMAND STREAMS

1. Miley Cyrus, “Flowers”

2. Rema & Selena Gomez, "Calm Down"

3. Morgan Wallen, "Last Night"

4. Hans Zimmer, "First Step"

5. Fifty Fifty, "Cupid"

6. SZA, "Kill Bill"

7. Tom Odell, "Another Love"

8. J. Cole feat. Amber Coffman & The Cults, "She Knows"

9. Zach Bryan, “Something in the Orange”

10. Lady Gaga, "Bloody Mary"

Broader Trends: Genre Growth, Gender Gaps and Super Fans

Beyond the Canadian data, the report features a wealth of trend data about streaming and music consumption globally and in the U.S. The report has six focus areas, looking at genres; languages; streaming; music spending outside of streaming; soundtracks and syncs; and catalogue royalties. Here are some of the most interesting takeaways from those categories.

Overall, streaming is growing: global on-demand audio grew by 22.3% last year. The genres that saw the most growth were world, which includes K-pop and Afrobeats (26.2%); Latin music (24.1%); and country (23.7%). The report highlights that country has an influx of younger Millennial and Gen Z listeners, and that those listeners are not finding country music in the same ways as their parents: Gen Z country listeners are "48% more likely to discover new music through video and/or audio streaming services than the average U.S. music listener," Luminate reports.

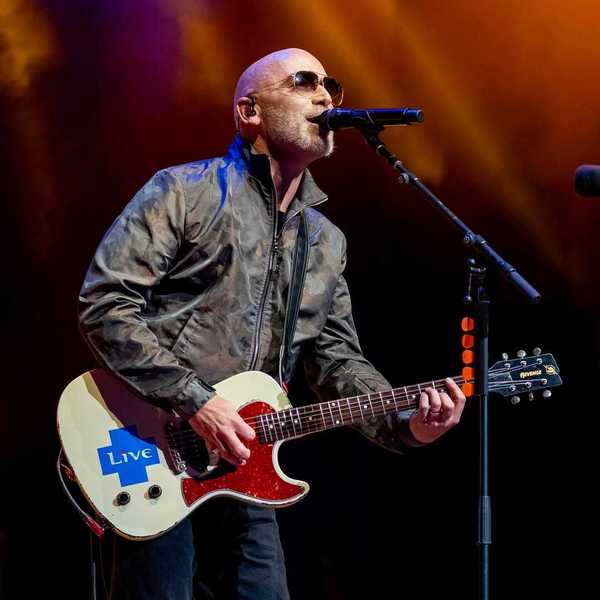

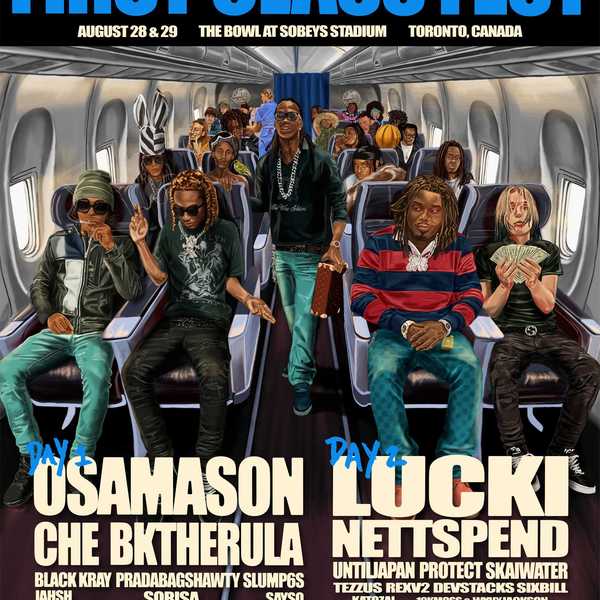

In Canada, Afrobeats had a big year thanks to Rema's "Calm Down," but Latin music has struggled to break through in the same way as in the U.S., with 2023 heavy-hitters Peso Pluma and Karol G failing to land on Canada's year-end charts. Country is very popular here, with Morgan Wallen and Zach Bryan both well-represented on the year-end charts, and Live Nation Canada launching a new country music festival this April.

But some of country's newer stars — particularly, female artists like Megan Moroney and Lainey Wilson — aren't charting in the same way in Canada. The Luminate report indicates a big gender gap in the genre more broadly: within the top 500 country artists, female artists represented only 14.3% of the streaming share. This number has risen slightly since 2019, when it was 11.7%, but male artists like Wallen, Bryan and Luke Combs dominated the share in 2023. Beyond country, women artists are generally underrepresented amongst streaming's top artists. Within the top 500 streaming artists, female artists represented roughly 30% of the streaming share, while male artists represent over 50%.

The report also highlights what it calls the "super fan," highly engaged fans who express their enthusiasm through fandom and consider it an expression of their identity. The report describes 18% of U.S. music listeners as super fans, and says that super fans spend 68% more on music each month than the average listener, as well as 126% more on merchandise. Gen Z in general spends 51% more on artist merchandise than the average listener, and Gen Z indie rock fans are more likely to directly fund their favourite artists via platforms like Patreon and Venmo.

U.S. direct-to-consumer sales were up in 2023, rising by 38.6% (and seeing a major spike around the release of 1989 (Taylor's Version). Both vinyl and CD sales grew, with vinyl sales rising from 4.9 million to 6.8 million, and CD sales rising from 3.5 million to 3.9 million. More than 60% of direct-to-consumer sales were current titles, with rock claiming the highest genre share of sales, followed by pop.

Here are a few other observations from the Luminate report:

- 1 in every 78 US On-Demand Audio streams was represented by Taylor Swift

- Hip-hop is the leading genre in the U.S.

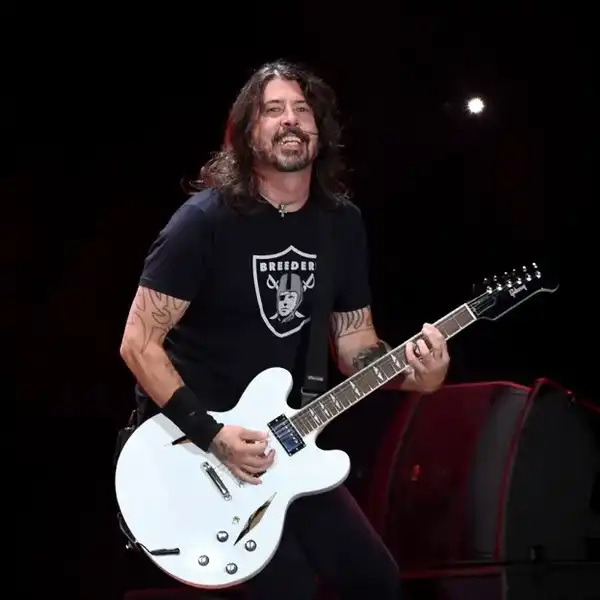

- Alt-rock is the largest growing sub-genre in the U.S. (and alt-rock fans are more likely to be Reddit users)

- 436k tracks were streamed one million or more times worldwide (an increase from 373.5k in 2022)

- Amongst the top 500k streamed tracks in the U.S., tracks released in the last 5 years make up 48.3%

Find the full report here.

- Morgan Wallen, The Weeknd, Bruno Mars & Lady Gaga Lead Midyear 2025 Canadian Music Rankings | Billboard Canada ›

- Morgan Wallen, The Weeknd, Bruno Mars et Lady Gaga dominent le classement musical canadien de mi-année 2025 | Billboard Canada ›

- Morgen Wallen, Alex Warren, Drake Take Top Spots in Luminate's Year-End 2025 Canadian Music Report | Billboard Canada ›

- Morgan Wallen, Alex Warren et Drake trônent en tête du palmarès annuel 2025 de Luminate consacré à la musique canadienne | Billboard Canada ›