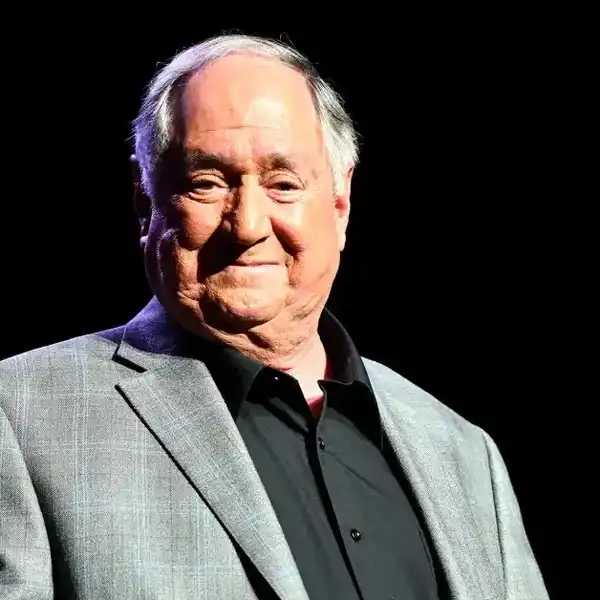

Nielsen's Paul Tuch Headlights Trends In Year-End Stats

There isn't much going on that Nielsen Music Canada's in-house statistician doesn't spot early on. FYI caught up with Paul this week to dig between the pages of Canada's most recent music business report card and his insights offer an easy read on what's going on today

By David Farrell

.Canada’s annual music business report card in 2017 was pretty rosy with significant gains in paid music-streams and record attendances and ticket sales reported by Nielsen Music Canada and the company’s affiliated Music 360 survey.

The headline here is that companies with deep catalogues and topline recording artists are making out very well in today’s music business that's all about bits, bytes and playlists. To some degree, this is good news too for the indie artists as greater profitability for these companies with deep catalogues means they have more to invest in domestic A&R.

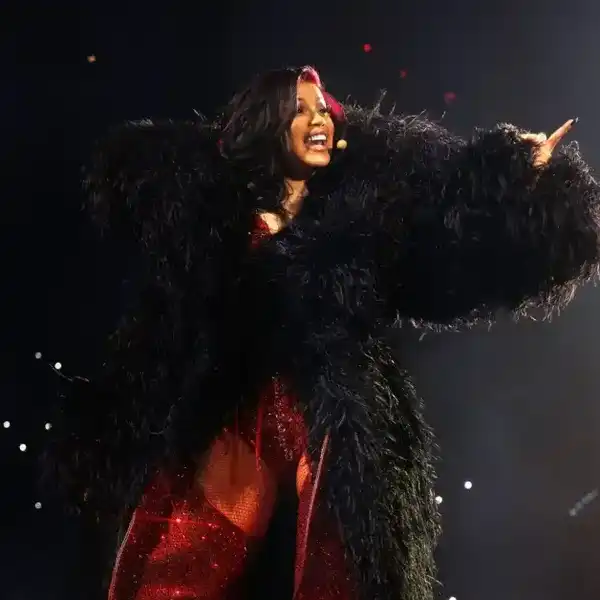

But there are other takeaways to be gleaned from the report card. Nielsen Music Canada director Paul Tuch points to the fact that R&B and rap are grabbing a larger share of the streaming pie. CD sales continue to be driven by pop and rock acts–but its music streaming that is driving the new business and as evidence of this, seven of the year’s top 10 on-demand streaming songs belonged to R&B/Hip-Hop acts. Among them, breakouts from Post Malone and Lil Uzi Vert.

Drake, The Weeknd and Kendrick Lamar each had albums in the top five overall consumption, while Future had two different albums debut at No. 1 in successive weeks, making the rapper the first artist to achieve such a feat in the Nielsen Music Canada era.

This fact will invariably be reflected in choices made by record companies when determining new signings, although mainstream artists including Alessia Cara and Shawn Mendes had a good year overall, as did Ed Sheeran, Taylor Swift, P!nk and crossover act The Chainsmokers.

Nielsen’s Tuch notes that the age-old trend of bunching superstar releases in the Christmas run-up is starting to fade as consumers shift from buying online and in music shops and shift to streaming as their primary music source. “Streaming isn’t as bunched up at the end of the year as people are listening year-round and trying to find new breakout stars.

“It doesn’t matter what time of year it is so much anymore. Maybe we’ll see the labels start to spread out some of their biggest releases throughout the year,” Tuch speculates.

Streaming income, for now, doesn’t amount to much for a significant number of Canada’s music acts–but working the channels leads to greater prominence and a better chance at earnings. Subscription platforms include Spotify, Apple, Google Play, Deezer, Amazon Music, Napster, SoundCloud, and Slacker Radio.

There’s also YouTube which is planning on launching a paid-subscription service this year; meantime, the Google-owned platform is the dominant video provider in the market with massive penetration and even more massive metrics when counting overall streams.

Last year, CD sales dipped 14-percent-but consumer purchases remained strong with 11M CDs sold, generating more than $110M in retail sales. Vinyl LP sales were up almost 22-percent with 804K purchases bringing in a guestimated $16M. It’s worth noting here that, in every category (vinyl, CD, downloads), catalogue outstripped new releases–although the spread in most cases was only by a few percentage points.

The cassette is trending as a cheap sales tool for some indie acts these days, and the numbers sold are increasing, albeit on a small scale. In 2017, Nielsen tracked 7,600 purchases, up 6-percent over the previous year.

Giving perspective, Tuch acknowledges that “physical sales are pointing down, but they’re still the dominant piece of the sales pie. People still buy CDs. It’s not a dead format,” adding that “with cassettes, compared to the rest of the landscape, it’s minuscule. Right now, it’s a blip, but that could change. Obviously many thought the vinyl craze was going to peter out and yet it keeps going.”

Radio trends

From Tuch’s catbird seat, formats have blended a lot more. “There are a lot more songs that are crossing over on CHR, Hot AC and Mainstream AC and there’s a lot of dayparting going on when it comes to the more rhythmic, urban material, especially on the hot AC and CHR side where there's increasingly less differentiation between the two formats."

There are still some differences, he opines, “but you definitely see a lot more songs that crossover. R&B and rap are doing much better; rock is a tough one – although there are some rock-based acts that do very well at Top 40 radio. Imagine Dragons is one example and Portugal. The Man really broke through this year–and they both started at alternative radio.

“But,” he cautions, “when you take a look at a lot of rock acts they do quite well at radio, but when you look at their streaming numbers, they’ve been far surpassed by most of the rhythmic acts."

And then there’s Quebec, a market where consumers continue to support their own and buy CDs. “Quebec has always been a unique part of the Canadian music landscape,” he says, adding that “there is a strong star system in the province and it continues to perform strongly” in producing some of the year’s best-sellers.

La belle province, he sums up, is a “province that continues to have a strong retail presence and has the lowest percentage decrease by region for CD sales."

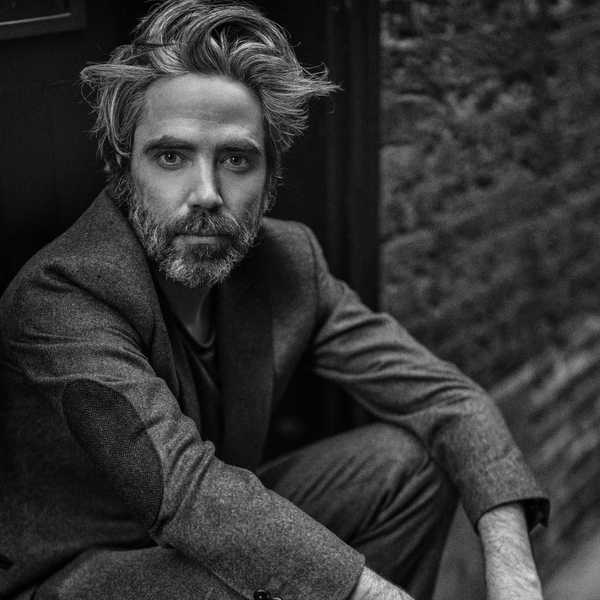

Felix Cartal shot at the W Toronto on Feb. 20, 2026. Lane Dorsey

Felix Cartal shot at the W Toronto on Feb. 20, 2026. Lane Dorsey  Felix Cartal shot at the W Toronto on Feb. 20, 2026.Lane Dorsey

Felix Cartal shot at the W Toronto on Feb. 20, 2026.Lane Dorsey