Coachella Ticket Sales Were Slower Than Usual, But Other Festivals Are Seeing a Dip Too

The Indio, Calif. event is still the No. 1 festival in the U.S. despite slower-than-average sales — but it's not alone in experiencing a dropoff.

After months of public handwringing over slow ticket sales, the annual Coachella Valley Music and Arts festival opens Friday (April 12) near Palm Springs with an anticipated attendance of nearly 200,000 fans over two weekends, sources tell Billboard, selling approximately 80% of the 250,000 tickets available for purchase this year.

How the shortfall will impact the festival’s bottom line is unclear, but the sources close to the festival say the dip in sales, down 14%-17% over last year, is not as bad as many had predicted. The first weekend of the festival has historically sold out of tickets in a few hours, but this year, it took nearly a month for tickets to the first weekend to sell out.

Coachella remains the most-attended and highest-grossing annual festival in North America, beating out Austin City Limits — which is also spread out over two weekends with an attendance capped at 75,000 people per weekend — and Electric Daisy Carnival at the Las Vegas Speedway, which saw attendance max out at more than 130,000 in 2022.

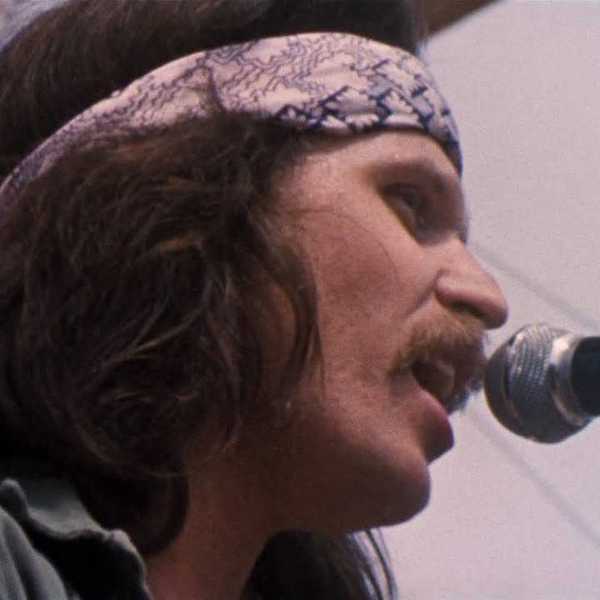

Coachella is also the largest media platform in the festival space, drawing in a massive viewership thanks to its partnership with YouTube and the hundreds of media credentials it assigns to major news outlets who provide nonstop coverage. In January, Gwen Stefani’s manager Irving Azoff told Billboard that one of the reasons No Doubt decided to stage their 2024 reunion performance at Coachella was due to the attention the festival attracted globally.

But Coachella’s size and cachet doesn’t make it immune to the challenges facing much of the festival industry. A number of popular festivals set for the second quarter of 2024 — New Orleans’ JazzFest, which runs from April 25 to May 5, along with L.A.’s Beach Life festival in early May and Daytona Beach’s famed Welcome to Rockville festival May 9-12 — have not sold out of tickets, for example. Other popular events later in the year, like Governors Ball in New York (June 7-9), Electric Forest (June 20-23) and Lollapalooza (Aug 1-4), which used to sell out days after going on sale, haven’t sold out either.

There’s little agreement on why sales have slowed. Ticket brokers used to buy up thousands of tickets to flip for profit on sites like StubHub, but sales volume for events like Coachella or Lollapalooza have dropped significantly in recent years as the markup potential has dwindled away.

Booking agents from major agencies representing A-list talent have begun arguing that festivals need to create more lucrative financial incentives to attract better headliners, while many independent agents link the decline to price increases that have made tickets unaffordable.

Ticket prices for Coachella increased $50 from 2022, when three-day GA passes cost $449, to $499 in 2024, an increase of about 11%. In 2019, prior to the pandemic, three-day GA passes were priced at $429.

Booking agent JJ Cassiere, co-founder of independent booking agency 33rd and West, says festival fans are more sensitive to price increases than they have been in the past, especially younger fans who are seeing their spending power eaten away by inflation.

“I’m very concerned about the fans who are finding themselves priced out of the market,” Cassiere tells Billboard, noting that even a $20 price increase can be a make-or-break hike for some fans.

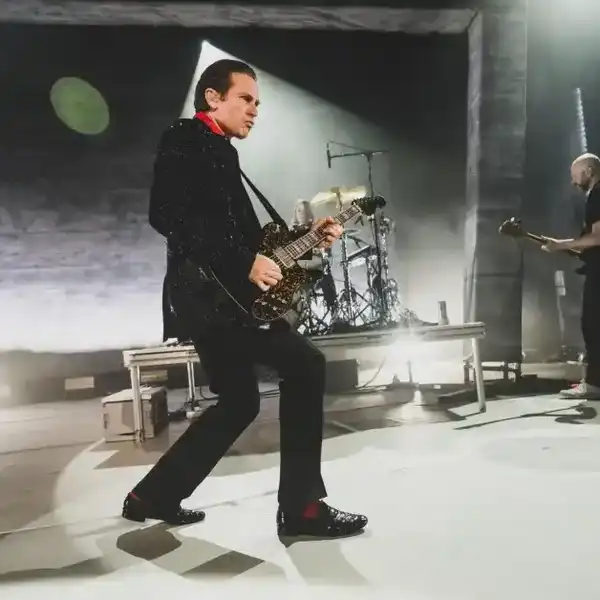

Other agents blame the dip in sales on headliner talent, arguing that the 2024 festival headliner pool — which, for Coachella, includes Lana Del Rey, Tyler the Creator, Doja Cat and No Doubt — doesn’t generate the same enthusiasm that touring artists like Taylor Swift and Beyoncé did in 2023.

The festival’s lineup is a sign “that Coachella and nearly all other festival bookers had limited options when it came to talent,” says one booking agent who has worked with the festival for over a decade and asked to speak anonymously for this article. “The number of artists wanting to tour around festivals this year is very small.”

For much of the 2010s, festivals were able to pay headlining artists as much as 50% more than artists would make headlining their own arena tours — after all, festivals often charged more for tickets, drew much larger crowds and covered much of an artist’s production costs. That began to change in 2016 and 2017, explains agent Jared Arfa with IAG, as ticketing companies like Ticketmaster and AEG AXS began focusing on the amount of money that scalpers were making selling tickets at large markups. To help close the gap and capture that revenue for artists, Arfa says, Ticketmaster and others began using programs like dynamic pricing and platinum to strategically increase the price of higher-demand tickets — such as front-row seats — and significantly increase how much artists were making at their own concerts.

The result has been a huge increase in price, with the top 10 tours of 2023 earning an average of $5.7 million per show compared to 2017, when the top 10 tours were averaging $3.6 million per show — a 58% increase in only six years.

“The issue for every festival now is that dynamic pricing is so good and prevalent that any artist big enough to headline a festival is more motivated to just headline their own shows,” one agent tells Billboard, noting that a headlining slot at Coachella in 2024 is less of a financial decision and more about artists “who are on their way up and need to make a statement.”

“In the future,” the agent continues, “festivals need to adjust to accommodate this changing reality, by either paying headliners more or booking stronger undercards — but that’s not easy.”

While headliners are important, Peter Shapiro with Brooklyn Bowl and Day Glo Ventures says spending more on talent isn’t always a viable long-term solution and notes that the best investments festival producers can make are in their festival community and overall experience.

“People attend festivals because they enjoy an outdoor experience with other fans in a setting that feels comfortable,” Shapiro says. “That won’t change and the more organizers can invest in improving that experience, the more it will pay off in the years ahead.”