Hipgnosis Slashes Valuation of Portfolio By 26%

The London-listed fund said it will focus on paying down debts and therefore extend its pause on paying dividends.

Hipgnosis Songs Fund logo

LONDON — Hipgnosis Songs Fund has cut the value of its portfolio by more than a quarter and told investors that it does not intend to recommence paying dividends “for the foreseeable future” as it focuses on paying down debts.

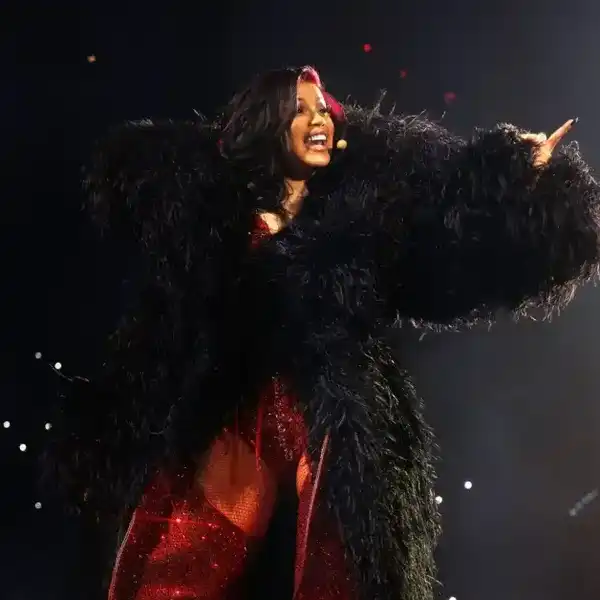

The London-listed fund, which owns full or partial rights to the song catalogs of Red Hot Chili Peppers, Neil Young, Justin Bieber and Blondie, among many others, announced the updated valuation on Monday (March 4).

It follows a detailed review of the company’s portfolio “on a bottom-up basis” by Shot Tower, which was appointed following a public fallout between the firm’s board and its investment advisor, the Merck Mercuriadis-led Hipgnosis Song Management (HSM), over the fund’s worth.

In a financial filing, Hipgnosis Songs Fund (HSF) said Shot Tower’s preliminary report estimates the fair market value of the company’s portfolio at between $1.8 billion and $2.06 billion (and $1.74 billion and $2 billion after deducting contingent catalog bonuses of just under $60 million).

Shot Tower gave a midpoint valuation of $1.93 billion, reflecting a multiple of 15.9x net royalty income, which is around 26% lower than the valuation of September 2023.

Hipgnosis Songs Fund said the new valuation was based on a range of criteria, including whether a catalog was made up of publisher, writer, producer or artist’s share of rights royalties. Shot Tower’s report also took into account royalty income streams and administration rights or copyrights due to be returned to the firm in future years, the fund said.

The firm’s cash net revenue (after third party royalty reductions and administration expenses) was $121.7 million for the 12-month royalty statement period ended June 30, 2023, according to Shot Tower’s analysis.

When adjusted solely for the new valuation, the company’s operative net asset value would be approximately $1.17 (92p) per share, compared to the last reported net asset value of $1.7392 (137p) per share at the end of September, the firm reported.

As a result of the decrease, the board said that it would be using free cashflow to pay down debt “and, therefore, does not intend to recommence paying dividends for the foreseeable future.”

In a statement accompanying the filing, Hipgnosis Songs Fund chairman Robert Naylor said the company’s newly constituted board “is making good progress with the due diligence work” underpinning its ongoing strategic review and that the board “remains focused on identifying all options to deliver shareholder value.”

Hipgnosis Songs Fund’s share price initially fell by 11% to £0.56 on Monday morning following the news.

The slashed valuation represents another blow for HSF, which underwent a turbulent end to 2023 and just-as-rocky start to the year.

In October, shareholders voted against the music royalties fund’s proposed $440 million deal to sell 29 catalogues to Hipgnosis Songs Capital – a partnership between investment giant Blackstone and the fund’s investment adviser Hipgnosis Song Management – citing the lack of an “up-to-date” valuation.

The same month’s annual meeting of shareholders also saw a majority of investors vote against a resolution “to continue running the fund in its current form” — a so-called “continuation vote” — commencing a six-month countdown for the board to come up with a plan “for the reconstruction, reorganisation, or winding-up of the company.”

That led to the installation of a new executive board with Naylor replacing Andrew Sutch as chairman, while last month shareholders passed a special resolution that authorizes the payment of up to 20 million pounds ($25 million) to prospective bidders seeking to acquire the fund’s assets. The fund hopes that the enticement of a large fee will help draw potential bidders to acquire some of the company’s catalogs.

February also saw Mercuriadis step down as chief executive officer of Hipgnosis Song Management to take up a newly created chairman role with Ben Katovsky replacing him as CEO.

Shot Tower is due to present its final due diligence findings to the firm’s board later this month.

Felix Cartal shot at the W Toronto on Feb. 20, 2026. Lane Dorsey

Felix Cartal shot at the W Toronto on Feb. 20, 2026. Lane Dorsey  Felix Cartal shot at the W Toronto on Feb. 20, 2026.Lane Dorsey

Felix Cartal shot at the W Toronto on Feb. 20, 2026.Lane Dorsey