Reservoir Media Files to Sell Securities to Fund Acquisitions, Other Needs

The Nasdaq-traded company, which went public through a SPAC merger in 2021, plans to raise $100 million in a secondary offering.

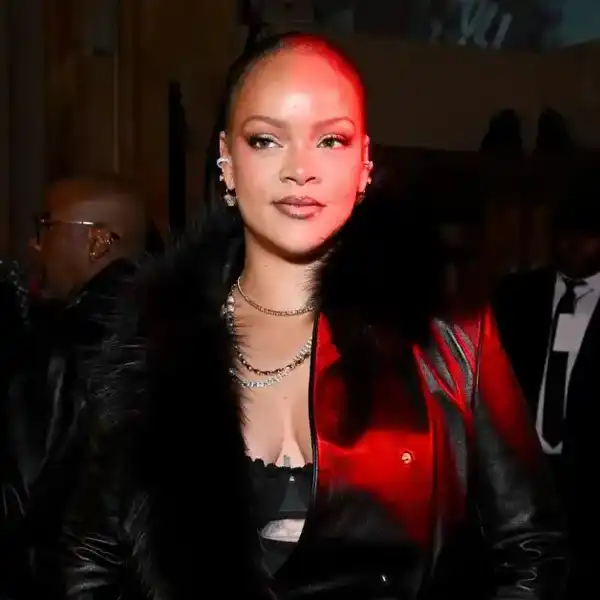

Golnar Khosrowshahi

Reservoir Media plans to sell an additional $100 million of securities, according to an S-3 filing with the Securities and Exchange Commission on Monday (April 29). The funds may go toward acquisitions, debt repayment, share buybacks and other general corporate purposes, according to the filing.

The company will often offer common stock, shares of its preferred stock, debt securities, depository shares, warrants, purchase contracts or a combination of these offerings, according to the filing. Reservoir Media currently has an authorized capital stock of 825 million shares — 750 million common shares and and 75 million shares of preferred stock. As of Feb. 5, it had 64.82 million shares of common stock outstanding. No shares of its preferred stock have been issued.

Tapping the market for additional capital now would enable Reservoir Media to benefit from a recent upswing in its share price. Its stock, which trades on the Nasdaq, reached a 52-week high of $9.20 per share on Friday (April 26) — and its highest point since May 4, 2022 — and closed at $9.03 on Monday (April 29), up 26.6% year to date. Reservoir Media went public in 2021 by merging with Roth CH Acquisition II, a special purpose acquisition corporation, or SPAC.

The company’s pipeline of potential deals was roughly $2 billion in total value, CEO Golnar Khosrowshahi (who is Canadian) said during the company’s Feb. 7 earnings call. “We remain a highly respected and regarded partner,” she said, “and our proven reputation for being a steward for catalogs through value enhancement initiatives allows us to acquire some of the best assets in the market.”

Since its inception in 2007, Reservoir Media has invested $938 million, according to its latest investor presentation — with $770 million of that amount spent on acquisitions of catalogs and companies. It owns Chrysalis Records, Tommy Boy Music and Philly Groove Records and manages artists through Blue Raincoat Music and Big Life Management.

In February, the company reported first-quarter revenue growth of 19%, to $35.5 million, and raised its guidance for full-year revenue to $140 million to $142 million, implying 15% annual growth at the midpoint.