Influential Canadian Music Executive Merck Mercuriadis Stepping Down as Hipgnosis Song Management Chairman

The move coincides with a proposed sale of the valuable and publicly traded Hipgnosis Songs Fund catalogue business to private equity firm Blackstone.

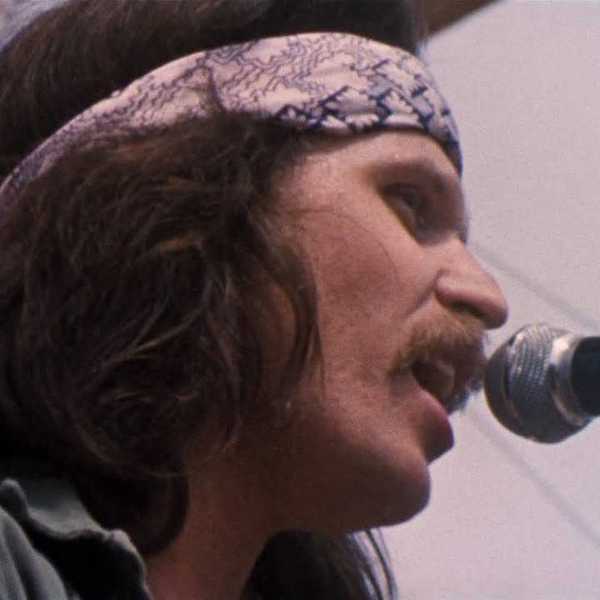

Merck Mercuriadis

Hipgnosis Song Management has announced that Merck Mercuriadis will be stepping down as Chairman of the music investment advisor. The move comes amidst an eventful year for the company, with Hipgnosis Songs Fund set to be acquired by private equity firm Blackstone.

The Canadian Hipgnosis founder, who was named to this year's Billboard Canada Power Players list, previously stepped down in February as CEO to become Chairman. His notice will go into effect upon closing of the proposed acquisition on July 8 if shareholders of the publicly traded catalogue side, Hipgnosis Songs Fund, vote to sell, reports Billboard Pro.

“With Hipgnosis Songs Fund and Hipgnosis Songs Assets we have created an outstanding catalogue of rights to an unrivalled collection of iconic and culturally important songs from phenomenal songwriters who I knew would be proud to stand next to each other,” Mercuriadis said in a prepared statement.

“HSM has been built on an ethos that has always put the songwriting community first and I am unwavering in the commitment I made to all our songwriters. I have always envisioned bringing songwriters together globally and organized to ensure they have a voice at the table, representing the consensus views of their community, in discussions about their compensation.”

Hipgnosis was part of a bidding war between Blackstone and Concord, which capped off a chaotic year that included infighting and numerous scandals while revealing how valuable the company's boasted $3 billion worth of assets are. That includes $400 million in 2023/2024 acquisitions of song catalogues by Justin Bieber, Shakira, Dua Lipa-songwriter Tobias Jesso Jr. and more – more than 50 No. 1 songs in total.

Under Mercuriadis, Hipgnosis led the way in turning song catalogues into an attractive asset class, which have become a hot investment in both the music industry and in the wider business world.

In his statement, the music executive said it was the “right time” and a “timely opportunity for me to undertake a strategic shift of focus.”